Automate communication, build trust, and deliver seamless customer service directly on WhatsApp.

Empower banks, NBFCs, insurers, lenders and investment firms to engage customers, automate onboarding, send reminders and provide 24/7 support.

WhatsApp builds trust and immediacy.

Email open rates lag far behind.

Simplifies KYC & application steps.

Auto-capture leads from forms, ads, social and QR campaigns. AI validates age, income, loan type and tags high-potential prospects.

AI guides customers through eligibility, product comparison, required documents, application steps and approval tracking.

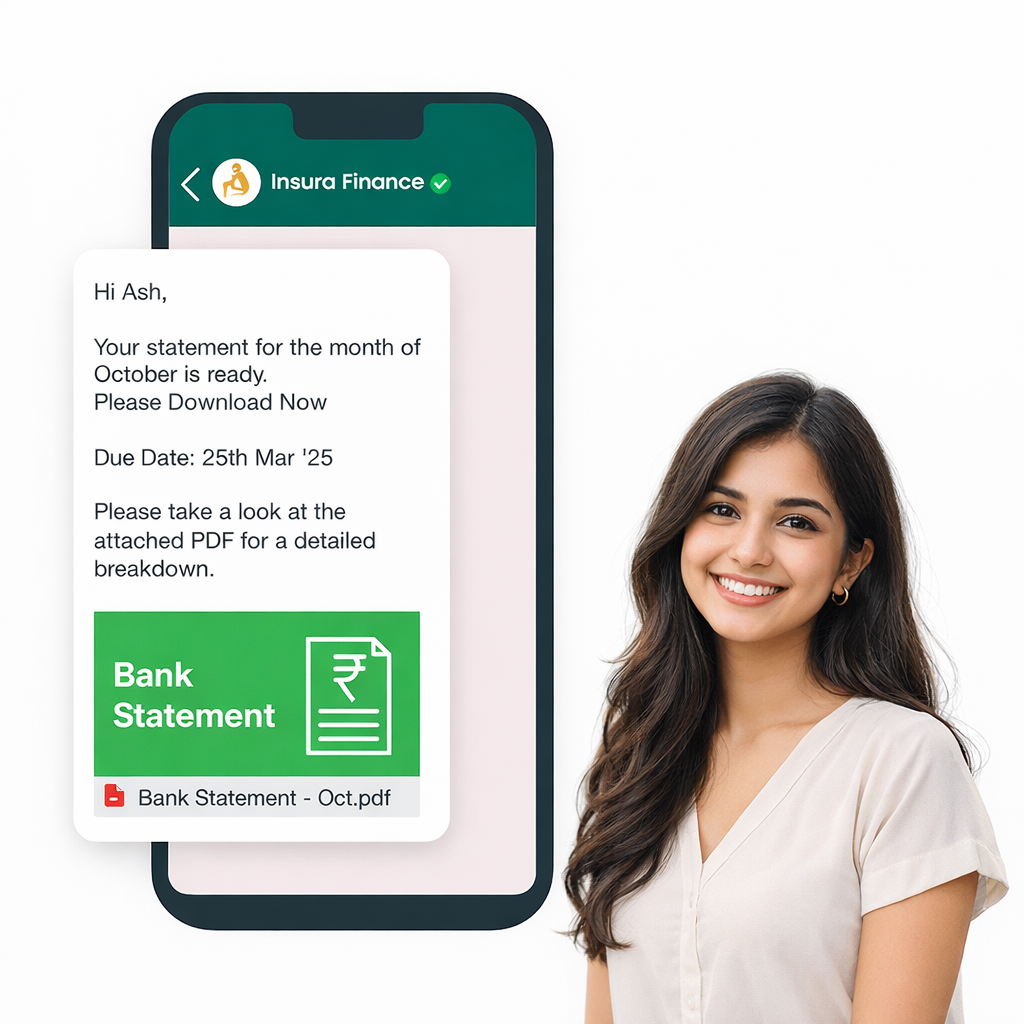

Send reminders for EMI, premium renewals, SIP alerts and overdue notices with payment links and receipts.

AI answers queries on balances, due dates, statements, claims, policy details — available 24/7 in multiple languages.

Collect PAN/Aadhaar, proofs, income docs via WhatsApp. AI validates readability and completeness.

Send market alerts, SIP reminders and personalized product suggestions to increase retention & upsells.

| Without Skynyx AI | With Skynyx AI |

|---|---|

| Missed follow-ups | Automated reminders |

| Slow onboarding | Quick digital workflows |

| High support load | AI answers 70–85% queries |

| Low response | WhatsApp 98% open rate |

| Manual document collection | Instant upload & verification |